A seismic shock is rippling through Canada’s energy sector as global oil giant ConocoPhillips executes a sweeping operational retreat, triggering mass layoffs and casting grave doubt on the future of its major Canadian projects. The move has ignited a political firestorm in Ottawa, with Prime Minister Carney reported to be furious over what senior sources describe as a catastrophic strategic blind spot.

The initial tremor was a terse corporate announcement of global workforce reductions targeting 20-25%, impacting up to 3,200 employees. In Alberta and British Columbia, the cuts arrived with surgical precision on November 5th, delivered via abrupt layoff calls that left entire departments reeling. But industry insiders and close observers immediately recognized this was far more than routine downsizing.

This is the deliberate, calculated opening move of a full-scale production reassessment, one that threatens to rip through the economic fabric of entire provinces. ConocoPhillips is not merely trimming staff; internal directives reveal a company preparing for “operational freeze periods” at key assets, language that signals a major structural shift is already in motion.

The catalyst was the company’s $22.5 billion acquisition of Marathon Oil. In its aftermath, ConocoPhillips activated a ruthless global asset ranking system, grading every operation by cost, carbon intensity, and regulatory friction. According to sources familiar with the process, Canada’s assets—particularly the capital-intensive Surmont oil sands project and the Montney gas play—landed squarely in the risk zone.

High operational costs, complex regulatory approvals, and rising carbon compliance expenses shoved Canadian operations down the priority list. Meanwhile, leaner U.S. shale assets, bolstered by the Marathon purchase, rose to the top. The company’s internal scorecard is designed to decide which regions earn future investment and which face downsizing or shutdown.

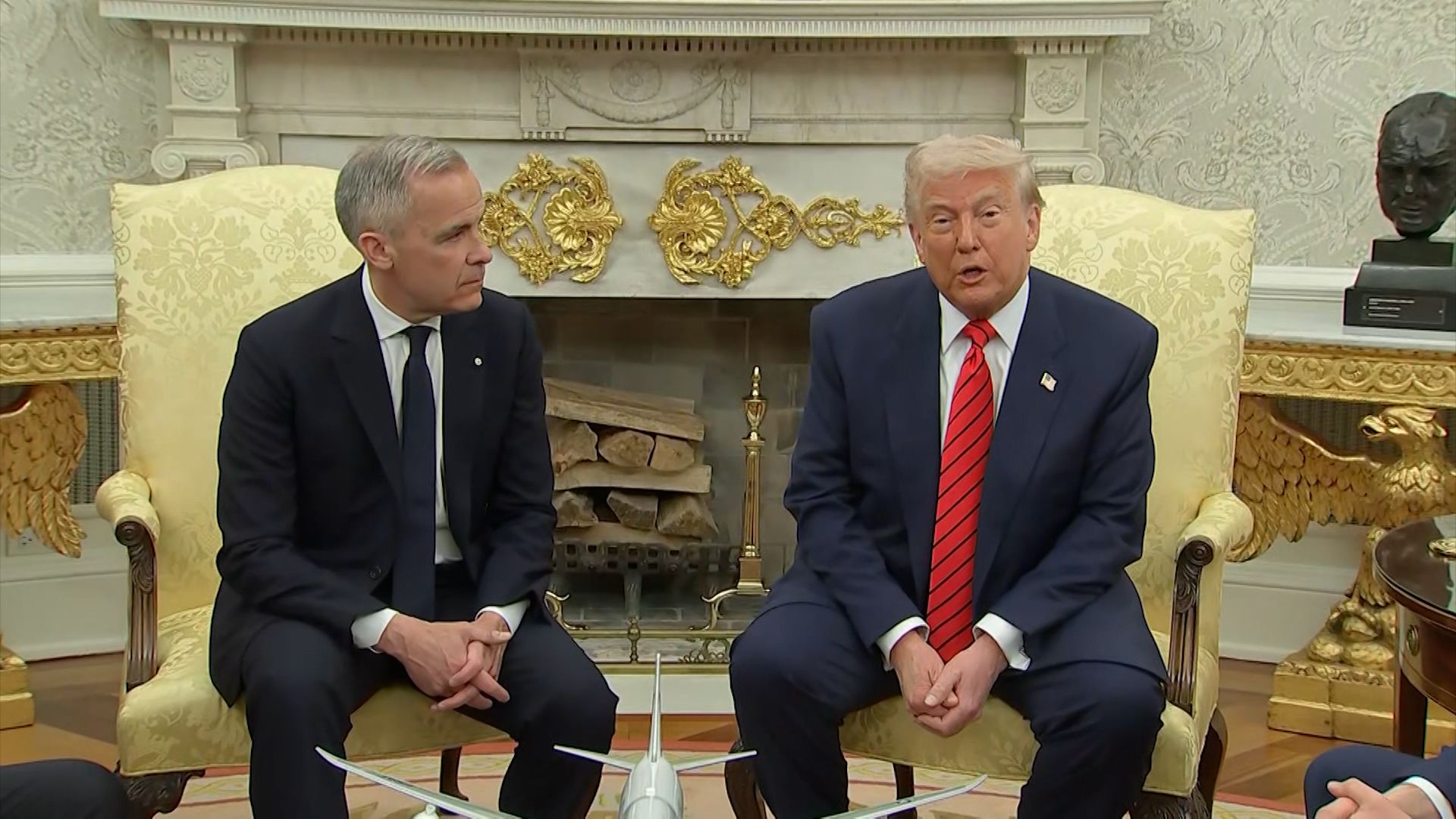

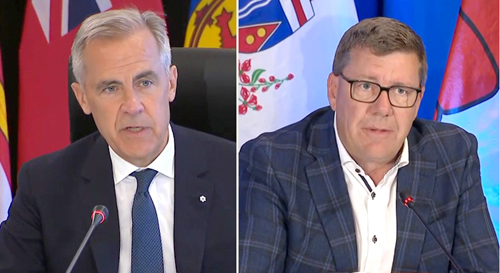

The political explosion in Ottawa was immediate. Prime Minister Carney’s reaction was described as raw and furious in closed-door sessions, angered that a multinational could dismantle a cornerstone of the national economy without warning. Alberta’s leadership seized the moment, hammering the federal government for creating an unattractive policy environment they claim drove the decision.

Behind the scenes, federal and provincial officials are scrambling to assess the fiscal fallout. The Surmont project alone feeds hundreds of millions into government coffers; a slowdown would blow holes in budgets and cripple municipal services in oil-dependent towns from Fort McMurray to Dawson Creek.

The human cost is escalating by the hour. Workers in company towns face a future of empty rigs and shrinking opportunity, with older employees fearing there is no re-entry into a tightening sector. Lawyers report a surge in calls about severance, as many laid-off workers are unaware that Canadian law may entitle them to far more than initial offers.

Compounding the crisis is the collapse of the $16.5 billion Pathways Alliance carbon capture plan. That project was the linchpin of the sector’s long-term emissions strategy, designed to secure the future of oil sands operations. Its failure leaves facilities like Surmont exposed to harsher carbon cost realities, making their long-term viability even harder to defend on a balance sheet.

This strategic retreat is amplified by a relentless industry-wide shift toward automation and AI-driven efficiency. Remote operation centers and autonomous rigs are systematically reducing the need for boots on the ground, a trend ConocoPhillips itself has embraced. The layoffs, while not officially tied to technology, underscore a brutal new reality where fewer workers are needed to produce more.

ConocoPhillips is not an outlier. Chevron, Shell, BP, and Imperial Oil have all been trimming headcounts and restructuring portfolios. A global realignment is underway, with capital migrating at speed toward regions where extraction is fast, flexible, and cheap: U.S. shale, Middle Eastern expansion, and liquefied natural gas mega-projects.

In this new world order, high-cost, slow-moving jurisdictions like Canada sit on the fault line. Investors are abandoning patience for complex approvals and policy uncertainty when competitors deliver cleaner balance sheets with quicker returns. The metrics are unforgiving: every dollar invested in Canada now delivers less output and more risk than the same dollar in Texas or New Mexico.

The question now haunting Ottawa and Edmonton is not if, but who follows. ConocoPhillips has acted first, rewriting its global map and pushing Canada toward the margins. The warning it sends is deafening: without a dramatic recalibration of competitiveness and regulatory coherence, this retreat may be just the first of many, leaving Canada watching as the next wave of global energy investment passes it by entirely. The future of the sector, and the communities it supports, now hangs in the balance.