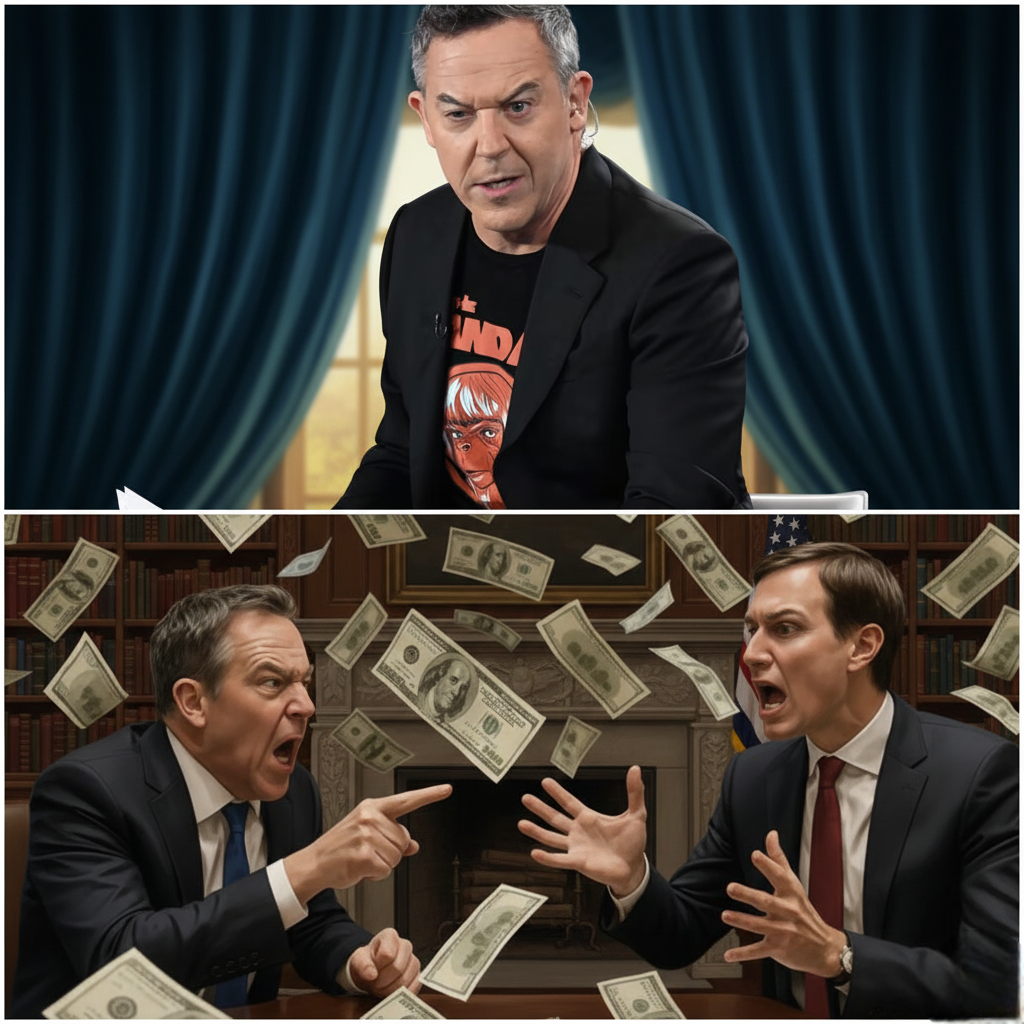

In the hallowed halls of the Capitol, where political theater is often scripted and predictable, true moments of shock are rare. Yet, yesterday morning, the nation witnessed a deviation from the script so sharp and sudden that it has left Washington reeling. What began as a routine oversight hearing regarding financial ethics and foreign investments transformed instantly into a political earthquake when Greg Gutfeld—ordinarily known for his sharp wit and late-night satire—dropped a legislative grenade that targeted one of the most high-profile financial mysteries of the last decade: Jared Kushner’s $2 billion investment fund. The hearing was proceeding at a glacial pace until Gutfeld, appearing as a witness regarding media transparency and political funding, pivoted the conversation. With a stack of documents in front of him, he bypassed the expected talking points and zeroed in on the massive influx of capital into Kushner’s private equity firm, Affinity Partners, specifically focusing on the Saudi-backed billions that have long raised eyebrows among ethics watchdogs. But it wasn’t the amount of money that caused the room to stop breathing. It was the detail Gutfeld revealed about where the money was actually going.  The Question That Stopped the Clock Witnesses describe the atmosphere in the room as shifting from bored complacency to electric tension in a heartbeat. Gutfeld looked up from his notes, locked eyes with the committee, and asked a question that seemed to suck the oxygen out of the chamber. He didn’t just ask about the ethics of the deal; he referenced a specific, obscure transaction code and a “liquidity clause” that allegedly obscures the ultimate beneficiary of the fund’s returns. “We keep talking about who gave the money,” Gutfeld stated, his voice cutting through the ambient noise of the hearing room. “But why aren’t we talking about who actually holds the kill switch on that two billion dollars? Because according to these filings, it isn’t Mr. Kushner.” For exactly 37 seconds following that statement, the room went silent. There was no banging of the gavel, no objections from counsel, and no murmurs from the gallery. It was the silence of a room realizing that a line had been crossed—a line between public posturing and dangerous reality. The Vanishing Documents The drama intensified when Gutfeld attempted to display a digital schematic of the fund’s structure on the hearing room’s monitors. For several seconds, a complex web of offshore accounts and shell companies flashed across the screens, highlighting a pathway that appeared to bypass standard U.S. regulatory oversight. Then, abruptly, the screens went black. While technical glitches are not uncommon in government buildings, the timing was suspicious enough to send reporters in the room into a frenzy. Aides were seen whispering frantically to committee members, and security personnel briefly moved toward the press gallery, requesting that cameras be lowered while “technical difficulties” were addressed. “It was surreal,” said one beat reporter who was present. “One second we are looking at a flow chart that links American influence to foreign entities in a way I’ve never seen visualized, and the next, the screen is dead and they are calling for a recess. You don’t see that kind of panic unless someone accidentally showed the truth.” The $2 Billion Shadow The core of Gutfeld’s exposure revolves around the $2 billion investment from the Saudi Public Investment Fund (PIF) into Kushner’s firm. While the investment itself has been public knowledge, the operational mechanics have remained opaque. Critics have long argued that Kushner’s firm, formed immediately after he left the White House, lacked the track record to warrant such a massive infusion of cash, leading to accusations of selling influence or purchasing future favors. However, Gutfeld’s testimony suggested something far more precarious than simple corruption. He implied that the structure of the fund creates a leverage point—a financial “trap door”—that could theoretically allow foreign actors to exert direct pressure on U.S. policy by threatening the immediate liquidation of assets. By framing the issue not as a business deal but as a national security vulnerability, Gutfeld reframed the narrative. He painted a picture where the $2 billion isn’t just an investment portfolio; it is a leash. The “Surprising Detail” That Lit Up Social Media Perhaps the most viral moment of the event came when Gutfeld dropped the detail that has since set social media ablaze. He alleged that a specific clause in the investment agreement—buried under thousands of pages of legalese—requires quarterly “compliance audits” conducted not by American regulators, but by a foreign third-party agency with ties to intelligence services. “We are looking at a situation where a former senior advisor to the President is contractually obligated to open his books to foreign agents every three months,” Gutfeld asserted. “If that doesn’t terrify you, you aren’t paying attention.” This revelation challenges the narrative that Kushner is merely a savvy businessman capitalizing on his connections. Instead, it posits that he may have unknowingly (or knowingly) entered into an agreement that compromises his autonomy.

The Question That Stopped the Clock Witnesses describe the atmosphere in the room as shifting from bored complacency to electric tension in a heartbeat. Gutfeld looked up from his notes, locked eyes with the committee, and asked a question that seemed to suck the oxygen out of the chamber. He didn’t just ask about the ethics of the deal; he referenced a specific, obscure transaction code and a “liquidity clause” that allegedly obscures the ultimate beneficiary of the fund’s returns. “We keep talking about who gave the money,” Gutfeld stated, his voice cutting through the ambient noise of the hearing room. “But why aren’t we talking about who actually holds the kill switch on that two billion dollars? Because according to these filings, it isn’t Mr. Kushner.” For exactly 37 seconds following that statement, the room went silent. There was no banging of the gavel, no objections from counsel, and no murmurs from the gallery. It was the silence of a room realizing that a line had been crossed—a line between public posturing and dangerous reality. The Vanishing Documents The drama intensified when Gutfeld attempted to display a digital schematic of the fund’s structure on the hearing room’s monitors. For several seconds, a complex web of offshore accounts and shell companies flashed across the screens, highlighting a pathway that appeared to bypass standard U.S. regulatory oversight. Then, abruptly, the screens went black. While technical glitches are not uncommon in government buildings, the timing was suspicious enough to send reporters in the room into a frenzy. Aides were seen whispering frantically to committee members, and security personnel briefly moved toward the press gallery, requesting that cameras be lowered while “technical difficulties” were addressed. “It was surreal,” said one beat reporter who was present. “One second we are looking at a flow chart that links American influence to foreign entities in a way I’ve never seen visualized, and the next, the screen is dead and they are calling for a recess. You don’t see that kind of panic unless someone accidentally showed the truth.” The $2 Billion Shadow The core of Gutfeld’s exposure revolves around the $2 billion investment from the Saudi Public Investment Fund (PIF) into Kushner’s firm. While the investment itself has been public knowledge, the operational mechanics have remained opaque. Critics have long argued that Kushner’s firm, formed immediately after he left the White House, lacked the track record to warrant such a massive infusion of cash, leading to accusations of selling influence or purchasing future favors. However, Gutfeld’s testimony suggested something far more precarious than simple corruption. He implied that the structure of the fund creates a leverage point—a financial “trap door”—that could theoretically allow foreign actors to exert direct pressure on U.S. policy by threatening the immediate liquidation of assets. By framing the issue not as a business deal but as a national security vulnerability, Gutfeld reframed the narrative. He painted a picture where the $2 billion isn’t just an investment portfolio; it is a leash. The “Surprising Detail” That Lit Up Social Media Perhaps the most viral moment of the event came when Gutfeld dropped the detail that has since set social media ablaze. He alleged that a specific clause in the investment agreement—buried under thousands of pages of legalese—requires quarterly “compliance audits” conducted not by American regulators, but by a foreign third-party agency with ties to intelligence services. “We are looking at a situation where a former senior advisor to the President is contractually obligated to open his books to foreign agents every three months,” Gutfeld asserted. “If that doesn’t terrify you, you aren’t paying attention.” This revelation challenges the narrative that Kushner is merely a savvy businessman capitalizing on his connections. Instead, it posits that he may have unknowingly (or knowingly) entered into an agreement that compromises his autonomy.  Washington Scrambles for Control In the hours following the hearing, the reaction has been a chaotic mix of denial and deflection. Representatives for Kushner have dismissed Gutfeld’s claims as “theatrical nonsense” and “conspiracy theories devoid of financial literacy,” insisting that Affinity Partners operates in full compliance with all U.S. laws and regulations. Yet, the behavior inside the Capitol suggests genuine concern. Emergency meetings were reportedly called within both parties to assess the damage. If Gutfeld’s documents are authentic, they could trigger a distinct DOJ inquiry, separate from the political theatrics of Congress. The silence of the mainstream political establishment is deafening. Usually quick to defend or attack, key figures have remained tight-lipped, likely waiting to see if more documents emerge or if the “glitch” that hid the evidence was a temporary reprieve. The Verdict Greg Gutfeld, usually the man making America laugh at the absurdity of politics, has inadvertently become the face of a new demand for transparency. By asking the question that no one else dared to voice, he has exposed the fragility of the firewalls meant to separate personal profit from public service. As the dust settles, the question remains: Who is really in charge of that $2 billion? The silence in the hearing room may have only lasted 37 seconds, but the echo of that silence is likely to last until the next election cycle. The American public is watching, and for the first time in a long time, they feel they might be close to seeing what is actually happening behind the curtain.

Washington Scrambles for Control In the hours following the hearing, the reaction has been a chaotic mix of denial and deflection. Representatives for Kushner have dismissed Gutfeld’s claims as “theatrical nonsense” and “conspiracy theories devoid of financial literacy,” insisting that Affinity Partners operates in full compliance with all U.S. laws and regulations. Yet, the behavior inside the Capitol suggests genuine concern. Emergency meetings were reportedly called within both parties to assess the damage. If Gutfeld’s documents are authentic, they could trigger a distinct DOJ inquiry, separate from the political theatrics of Congress. The silence of the mainstream political establishment is deafening. Usually quick to defend or attack, key figures have remained tight-lipped, likely waiting to see if more documents emerge or if the “glitch” that hid the evidence was a temporary reprieve. The Verdict Greg Gutfeld, usually the man making America laugh at the absurdity of politics, has inadvertently become the face of a new demand for transparency. By asking the question that no one else dared to voice, he has exposed the fragility of the firewalls meant to separate personal profit from public service. As the dust settles, the question remains: Who is really in charge of that $2 billion? The silence in the hearing room may have only lasted 37 seconds, but the echo of that silence is likely to last until the next election cycle. The American public is watching, and for the first time in a long time, they feel they might be close to seeing what is actually happening behind the curtain.

$2 BILLION Mystery: Gutfeld Exposes Kushner’s Hidden Funds, Then Silence Fell